If you've been considering solar panels for your home, there's a significant deadline approaching that could cost you thousands. The federal solar tax credit—officially called the Residential Clean Energy Credit—is set to expire completely after December 31, 2025. This isn't just another tax change; it represents a potential $7,500+ difference in what you'll pay for a typical home solar system.

For homeowners in Florida and Illinois, two states where we at TCI Roofing and Solar frequently install systems, this deadline carries particular significance. Let's break down what you need to know and why 2025 might be your last chance to maximize your solar investment.

Understanding the Solar Tax Credit: The Basics

The federal solar tax credit has been one of the most powerful financial incentives driving residential solar adoption across America. Currently set at 30%, this credit allows homeowners to deduct nearly a third of their solar installation costs directly from their federal tax liability.

Unlike a deduction that merely reduces taxable income, this is a dollar-for-dollar credit against taxes owed. For a typical $25,000 solar system, that's $7,500 back in your pocket—assuming you have sufficient tax liability.

But here's the critical part: unlike previous years where we saw gradual step-downs, there is no phase-out period this time. After December 31, 2025, the residential credit drops from 30% to zero overnight.

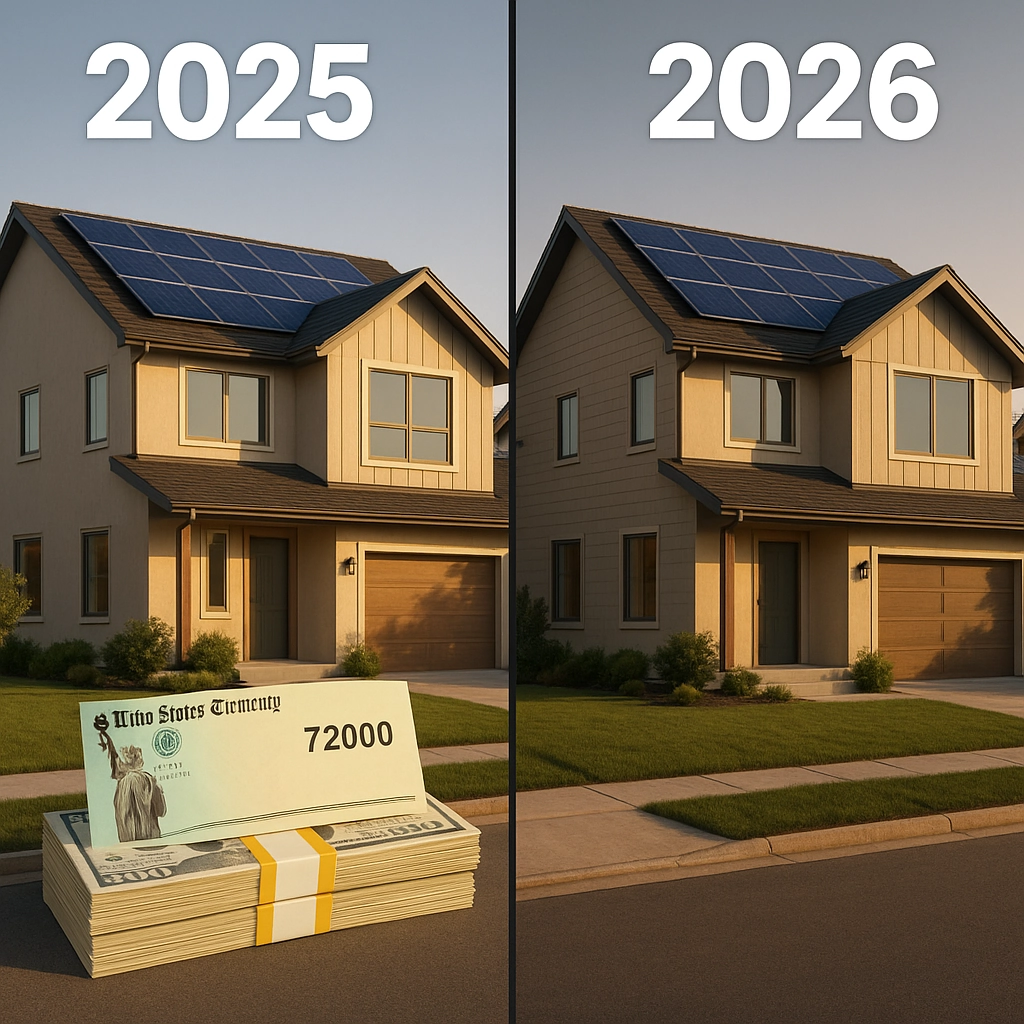

The Financial Impact: Running the Numbers

Let's put this in perspective with some real numbers for a typical Florida or Illinois home:

Before Tax Credit Expiration (2025):

- Average 8kW system cost: $24,000

- 30% federal tax credit: -$7,200

- Net cost after tax credit: $16,800

After Tax Credit Expiration (2026):

- Same 8kW system cost: $24,000

- Federal tax credit: $0

- Net cost: $24,000

That's a $7,200 difference—enough to buy a decent used car or fund a home renovation project. This substantial increase affects every aspect of your solar investment:

- Payback period extends by approximately 2-3 years

- Return on investment (ROI) decreases significantly

- Monthly savings relative to installation costs drop by 30%

Florida Homeowners: Special Considerations

Florida's "Sunshine State" nickname makes it ideal for solar, but the state has fewer supplemental incentives than others, making the federal tax credit especially valuable for Floridians.

What Florida Homeowners Will Still Have:

- Net metering (though policies vary by utility)

- Property tax exemption for residential solar installations

- Sales tax exemption on solar equipment purchases

What Florida Homeowners Will Lose:

- The 30% federal credit that often makes the difference between a 7-year and 10-year payback period

- The financial cushion that offsets Florida's relatively low electricity rates in some areas

For our Pasco County and New Port Richey customers especially, we've observed that the federal credit often represents the tipping point that makes solar financially attractive despite modest electricity rates. Without it, the value proposition changes substantially.

Illinois Homeowners: Different State, Similar Deadline

Illinois homeowners face a slightly different scenario thanks to the state's more robust solar incentives, but the federal deadline still looms large.

What Illinois Homeowners Will Still Have:

- Illinois Shines program (Adjustable Block Program) offering Solar Renewable Energy Credits (SRECs)

- Net metering policies that credit homeowners for excess generation

- Property tax breaks for adding solar to your home

What Illinois Homeowners Will Lose:

- The substantial 30% federal credit that works alongside state incentives

- The combined incentive package that has made Illinois one of the fastest-growing solar markets

Even with the Illinois Shines program continuing, the loss of the federal credit will still increase payback periods by approximately 2-4 years for most Illinois homeowners.

The Timeline Crunch: Why You Can't Wait Until December 2025

Here's where many homeowners make a critical mistake: assuming they can wait until late 2025 to start their solar project. In reality, several factors make this risky:

-

Installation backlogs: As the deadline approaches, installer schedules will fill up rapidly.

-

Permitting delays: Local building departments will face increased application volumes.

-

Equipment shortages: Supply chain issues could resurface as demand surges.

-

Weather considerations: Winter weather in Illinois and summer storm seasons in Florida can delay installations.

Most importantly, to qualify for the tax credit, your system must be "placed in service" (fully installed and operational) by December 31, 2025. Starting the process in late 2025 could easily push you past this deadline.

The Installation Timeline Reality Check

Based on our experience at TCI Roofing and Solar, here's a realistic timeline for getting solar installed:

- Initial consultation and site assessment: 1-2 weeks

- System design and proposal finalization: 1-2 weeks

- Permitting and utility approval: 2-8 weeks (varies significantly by location)

- Equipment ordering and delivery: 2-6 weeks

- Installation: 1-3 days (typically)

- Final inspection and permission to operate: 2-4 weeks

That adds up to approximately 2-5 months from start to finish under ideal conditions. As the deadline approaches, expect these timeframes to extend significantly.

Making Solar Work After the Credit Expires

If you miss the 2025 deadline, solar can still make financial sense, but the equation changes:

Alternative Approaches After 2025:

- Focus on energy efficiency first to reduce system size requirements

- Consider solar batteries to maximize self-consumption and emergency preparedness

- Explore green financing options with lower interest rates

- Look into community solar as an alternative to rooftop installation

- Phase your installation with critical loads first if budget is constrained

The Long-Term Perspective

Even without the tax credit, solar remains a sound investment for many homeowners, especially considering:

- Rising utility rates make solar savings grow over time

- Home value increases of 4.1% on average with solar (according to Zillow research)

- Energy independence and reduced exposure to utility rate fluctuations

- Environmental benefits that many homeowners value beyond pure financials

What to Do Right Now: Action Steps

If you're considering solar in Florida or Illinois, here's your strategic roadmap:

-

Schedule a solar consultation as soon as possible to understand your specific situation. At TCI Roofing and Solar, we provide free, no-obligation assessments.

-

Get multiple quotes to compare options (though we're confident in our value proposition).

-

Check your tax liability with an accountant to ensure you can fully utilize the credit.

-

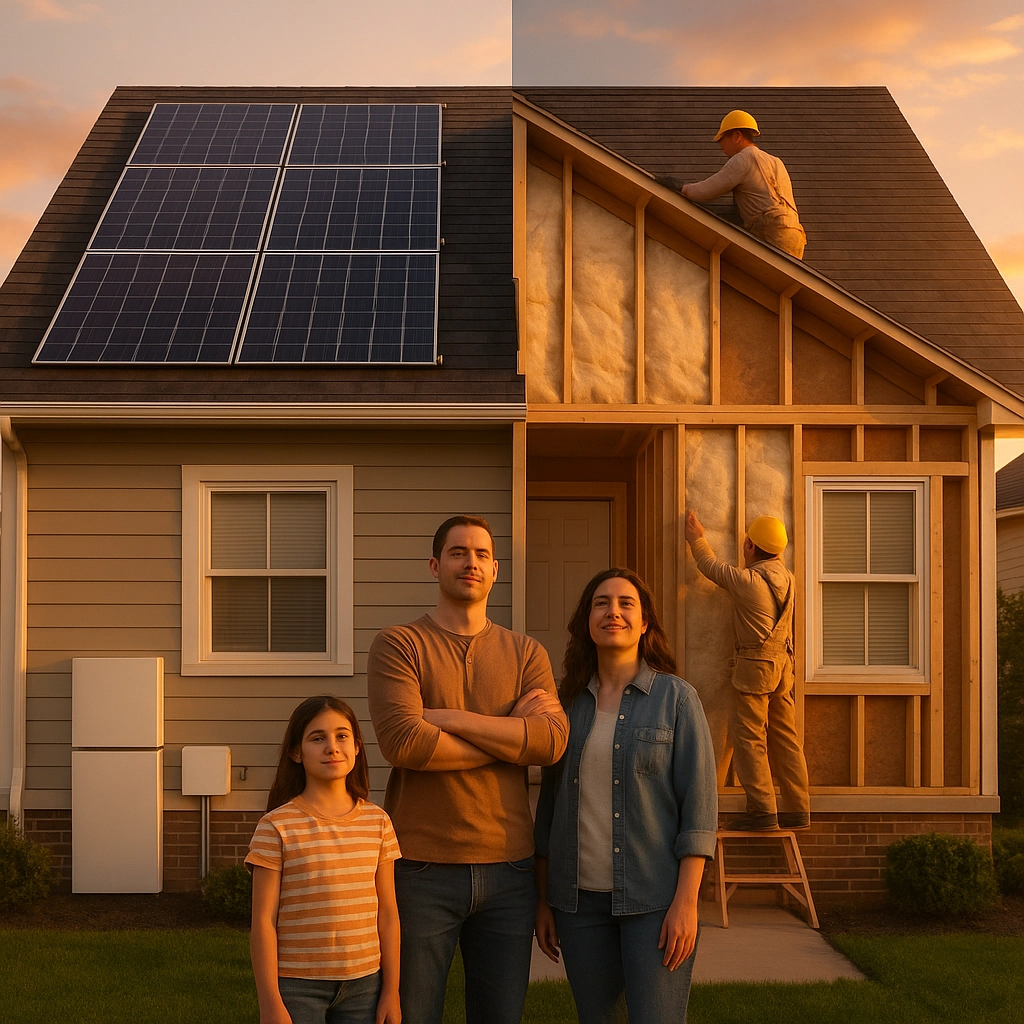

Review your roof condition. Consider bundling a roof replacement with your solar installation if your roof is aging.

-

Improve home efficiency with measures like blown-in insulation to reduce your overall energy needs.

-

Target installation completion by mid-2025 to provide buffer time for unexpected delays.

Conclusion: The Clock Is Ticking

The end of the solar tax credit represents a significant shift in the financial equation for homeowners. While solar will continue to make sense for many after 2025, the difference in out-of-pocket costs is substantial enough that acting before the deadline could save you thousands.

For Florida homeowners battling high cooling costs and seeking hurricane resilience, and for Illinois residents facing volatile seasonal energy demands, the 2025 deadline offers a closing window of maximum incentives.

At TCI Roofing and Solar, we're committed to helping you navigate this transition with transparent information and quality installations. Whether you're in Florida or Illinois, we recommend starting your solar journey soon to avoid the inevitable rush as the deadline approaches.

Don't let this significant financial incentive slip away. Contact us today to schedule your free solar assessment and take the first step toward locking in your 30% tax credit before it disappears forever.